Run a Subscription as a Service (SaaS) business? Annual recurring revenue (ARR) is your bread and butter, my friend.

It's how you'll measure your success, track your growth and finally – hopefully – value and exit your business. It's a better indicator of how you're doing than monthly recurring revenue, and it's the most important metric almost all investors in the space will want to know when evaluating a business.

Put simply, annual recurring revenue is metric ONE. So what is it?

Annual recurring revenue, or ARR, is a metric *specifically for the subscription economy* that gives an indication of the revenue that is taken in each year of the life of current subscriptions or contracts.

Therefore, annual recurring revenue is the total value of the recurring revenue of a company's term subscriptions normalized as a figure for a single year. For example, if a single subscriber were to purchase a 2-year subscription for $10,000, the ARR would be $5,000. If three subscribers had purchased those 2-year subscriptions, the ARR would be $15,000.

Why is it important to measure ARR in a subscription business?

If you remember one thing, remember this: ARR is important because it measures the health of a business that is based on subscriptions.

ARR is the amount of revenue that a business is set to repeat, so it is a great indicator of company progress and a tool to predict future growth with a degree of accuracy and realism that non-subscription businesses just don't have.

Clarifying the health of a company

It can also be useful for measuring areas where momentum is gathering or depleting, such as sales, renewals or upgrades, in order to determine where the company's efforts need to be focused at any given time.

Driving revenue growth

ARR should indicate the size and numbers of your active contracts, so tracking changes helps provide key insights into the needs and desires of your customers. This also helps to promote up-selling and cross-selling (which helps to further increase revenue).

Furthermore, by planning the cost and duration of different subscription plans, you can forecast the revenue a potential client will generate for you.

Attracting investor interest

Investors are a vital part of some businesses, and many investors prefer contractually-obligated revenue because it is predictable and measurable at all times.

As highlighted above, accurate revenue forecasting through a subscription-based economy is more attractive to investors than one-time sales. So subscription businesses that measure their ARR have the potential to secure bigger ticket deals at better valuations because owners will feel they are able to sell in a predictable and systematic way.

How to calculate ARR

To figure out your ARR for any given customer, you should divide the total value of a contract by the number of years it runs for. For example, if a customer agrees to a 5-year contract for a payment of $5,000, you should divide the total cost ($5,000) by the number of years (5), resulting in an ARR of $1,000 per year. Similarly, if a customer chooses not to renew a 2-year contract worth $8,000, you should divide the contract cost ($8,000) by the number of years (2), resulting in an ARR decrease of $4,000 per year. Then, sum all your ARR from individual customers for your total ARR.

Note: ARR only covers fixed contract fees and is not related to any one-time charges. Single charges, also known as variable revenue, should be separately accounted for. If you attempt to lump any additional, non-subscription charges into your ARR calculation, your results will not be accurate.

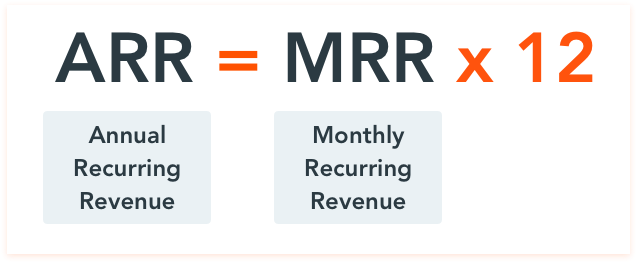

What about monthly recurring revenue (MRR)?

Accounting purists suggest that when you calculate ARR, it should only be done in relation to annual terms, so the minimum contract size has to be one year – any subscriptions that have terms which are under a year should not be recorded in your ARR calculations.

The thinking here is that these subscription contract types are short-term, often allowing the cancellation of a subscription within 30 days.

However, most modern SaaS businesses will calculate ARR based on extrapolated monthly recurring revenue (MRR) as well as annual contracts. Profitwell have written a new, superb piece on this here.

So, if you have one customer paying you $250 per month, you have $250 of monthly recurring revenue and $3,000 of annual recurring revenue.

Any annual contracts from other customers can then be added directly to the extrapolated MRR figure.

The obvious caveat here is that extrapolating MRR into ARR relies on your customers staying for, on average, over one year. If you have customers who join and leave after six months, calculating ARR based on MRR will give you a hopelessly inaccurate number.

Other key terms related to annual recurring revenue (ARR)

As well as MRR, SaaS businesses need to understand the following concepts, which are typically used in relation to ARR (as we'll be using them below).

- Customer lifetime value (CLV): Also known as LTV or CLTV, CLV is an estimated projection of gross margin contribution over the lifespan of the average customer. Put more simply, it's a measure of the total amount of revenue you expect to receive from a given customer before they leave you. For more, read Hubspot's excellent piece.

- Churn: There are many variations of what, precisely, 'churn' is (see our piece on how it works with onboarding here), but it is always a measure/attrition of loss. This can come in the form of lost customers, recurring revenue, contracts, contract value or bookings.

- Renewal rate: This is a measure of customer retention – at the end of their contact, what percentage of your customers will renew? Renewal rate is typically used with reference to annual (or longer) contracts, while churn is more common in monthly contracts.

Strategies to optimize your ARR

Your ARR (or MRR) is the purest view of the momentum of your business.

The more recurring revenue being generated, the longer you can prolong a period of growth and expand your planning. Recurring revenue is what feeds your subscription machine, and without it, the wheels stop turning.

So how can you increase ARR?

Increase net customer acquisition: You can push your ARR higher by closing a greater number of qualified customers.

This relies on you optimizing your customer lifetime value (LTV or CLTV) and customer acquisition costs (CAC) so that you have an efficient acquisition strategy and low acquisition cost.

Increase expansionary revenue with upgrades and value metrics: Your existing customers represent a great opportunity to increase company revenue.

Boost LTV by increasing customer retention: When you retain customers, it creates an opportunity for more recurring revenue by increasing the depth of retained customers and extending the customer lifespan.

Are annual recurring revenue and annual run rate the same thing?

These two terms share the ARR acronym, and it is quite common for people to assume they are different names for the same thing. Here's how they differ:

- Annual run rate – this looks at yearly revenues extrapolated from shorter periods. For example, if you bring in £200,000 in the first 2 months of the year, you can make an annual run rate prediction of £1,200. In businesses like retail, where sales tend to be seasonal, it's essential to use the correct time frame to calculate this metric. So if you use November and December, where Christmas pushes sales higher, it will inevitably be overstated. Similarly, if you use February and March, it will probably be understated. A time frame that represents median business performance is best for calculating the annual run rate.

- Annual recurring revenue – Businesses like retail (for example) are unlikely to have an annual recurring revenue because they don't usually offer subscription-based options for customers. While annual run rate is a prediction of the year's revenue based on recorded revenue for a shorter period, annual recurring revenue is a snapshot of current performance which factors in future booked revenues.